Carbon Credits for Environmental Markets

Carbon Credit Products & Solutions

Carbon credits are tradable certificates or permits that represent the right to emit a specific amount of carbon dioxide or its equivalent amount in greenhouse gas (GHG). Once retired, they can no longer be traded. Also known as carbon allowances, carbon credits effectively work like permission slips for emissions, with each credit representing one ton of CO2 emissions. Unlike carbon offsets, carbon credits generally produce vertical revenue flows from companies to regulators. Nevertheless, a company may sell its excess credits to other companies.

Many businesses find they cannot eliminate, or even reduce emissions as quickly as they’d like. This is especially challenging for organizations pursuing net-zero targets. Targray’s Environmental Commodities team works to create effective carbon credit trading scenarios, helping carbon market participants meet ambitious goals for reducing GHG emissions without compromising their long-term growth objectives. Contact our experts to learn more about our carbon credit solutions, or for more information about our emissions trading programs.

How do Carbon Projects Generate Credits?

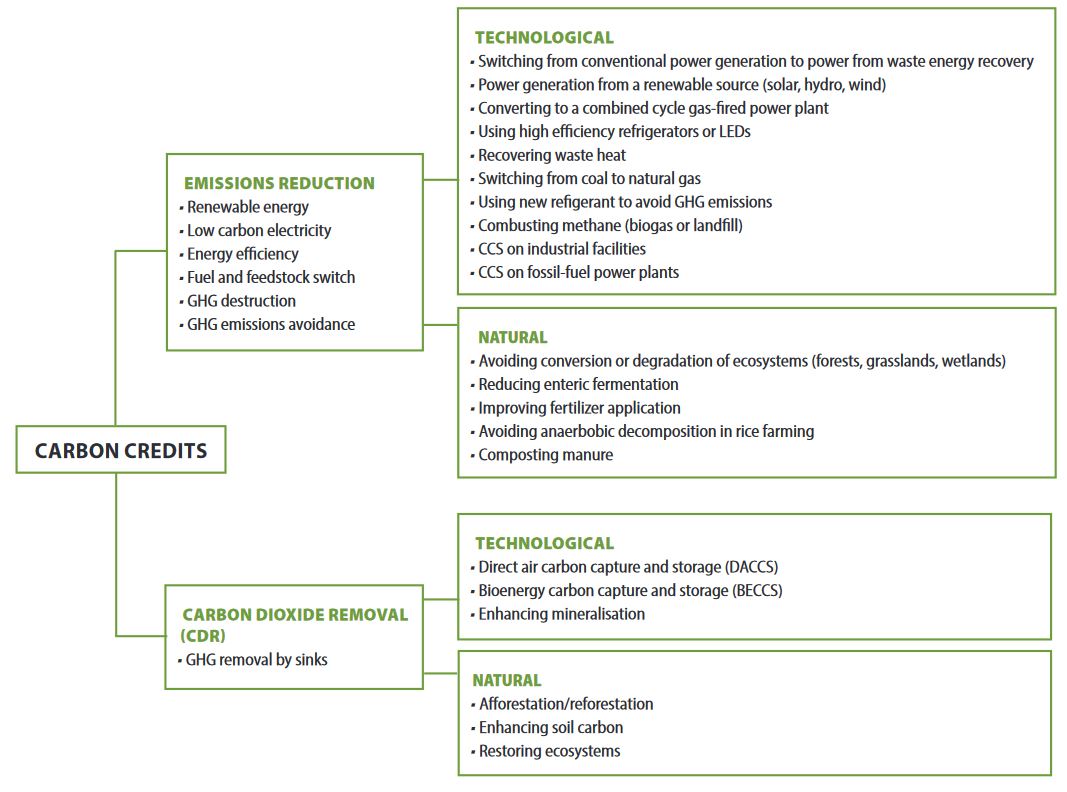

Carbon projects generate carbon credits either by voluntarily reducing emissions, or by removing carbon dioxide beyond business as usual. A carbon reduction occurs when an activity is implemented to avoid or reduce emission levels associated with a practice or process. For instance, switching from fossil fuel energy to renewable energy to power a factory reduces emissions. Carbon dioxide removal occurs when carbon dioxide is drawn out of the atmosphere and sequestered, such as through forest restoration. The below graphic illustrates different mitigation activities that reduce emissions or remove carbon dioxide.

Source: Evaluating the Use of Carbon Credits, Ceres.org

Emission offsets are an indispensable element of environmental sustainability, utilized to combat climate change by diminishing carbon emissions. These offsets form a pivotal part of the carbon trading market, serving as a vital tool for businesses, governments, project developers, and individuals aiming to reduce their carbon footprint. This article aims to elucidate the nature of emission offsets, their operational mechanisms, and their significance in the ongoing fight against climate change.

What are Carbon Credits?

Emissions offsets provide a means to quantify carbon emissions and counterbalance them through investments in initiatives that diminish greenhouse gas emissions. Each emissions offset symbolizes the prevention of one metric ton of carbon dioxide or its comparable quantity in other greenhouse gases from being discharged into the atmosphere. These offsets are commonly traded on emissions markets, where they can be purchased and sold akin to any other tradable asset.

How Do Carbon Exchange Work?

Carbon Exchange work by creating a financial incentive for companies and individuals to reduce their carbon footprint. For example, a company may invest in a renewable energy project, such as a wind farm or solar panel installation, to offset its carbon emissions. The company can then earn carbon emission points based on the amount of carbon dioxide that the project prevents from being released into the atmosphere.

Once a company has earned carbon credits, it can sell them on carbon markets to other companies or individuals who need to offset their carbon emissions. The price of carbon points varies depending on supply and demand, as well as the quality of the offset project. The price can fluctuate widely, making carbon trade a potentially lucrative investment opportunity for those who understand the market.

Why Carbon offseting is Important?

By creating a market for carbon credits, businesses and individuals can invest in renewable energy and other projects that reduce greenhouse gas emissions. This, in turn, can help to combat climate change and reduce the overall carbon footprint of the global economy.

Carbon points are also important because they help to support sustainable development in developing countries. Many carbon offset projects are located in developing countries, where they can provide much-needed investment in renewable energy and other sustainable development projects. This can help to create jobs and improve the standard of living in these countries, while also reducing global carbon emissions.

Emissions offsetting

Emissions trading involves the buying and selling of carbon credit on carbon markets. This intricate market necessitates a comprehensive comprehension of carbon markets and environmental sustainability. Engaging in emissions trading presents a potential avenue for profitable investment to individuals who are willing to dedicate time and effort to grasp the workings of the market.

To participate in emissions trading, it is crucial to have knowledge about the various types of credits available. There exist two primary categories: carbon reduction credits and carbon removal credits. Carbon reduction credits are earned by supporting projects aimed at diminishing greenhouse gas emissions, such as initiatives in renewable energy. Conversely, carbon removal credits are obtained by investing in endeavors that extract carbon dioxide from the atmosphere, like reforestation projects.

The market for emissions trading can be volatile, as prices experience significant fluctuations based on supply and demand dynamics. Conducting thorough research prior to investing in carbon markets is essential to ensure a comprehensive understanding of the market and make informed investment decisions.

Carbon Points

Carbon points are a way of tracking carbon emissions and offsetting them through carbon transactions. Carbon points are awarded based on the amount of carbon dioxide that a company or individual emits. Companies and individuals can then use carbon points to offset their carbon emissions by purchasing emission points on carbon markets.

Carbon points are a useful tool for tracking carbon emissions and reducing carbon footprints. By providing a way to track carbon emissions and offset them through carbon trading, carbon points can help to encourage businesses and individuals to reduce their carbon footprint and invest in sustainable development.

Conclusion

Carbon emission points are an important tool for reducing carbon emissions and combating climate change. Carbon trade is a complex market, but it provides a financial incentive for businesses and individuals to reduce their carbon footprint and invest in sustainable development. Carbon points are a useful way to track carbon emissions and offset them through carbon point exchange.

As the world continues to grapple with the effects of climate change, carbon credits will become increasingly important. They provide a way to reduce carbon emissions and invest in sustainable development, while also creating a financial incentive for businesses and individuals to take action. By understanding emissions trading and the carbon trading market, we can all play a role in combating climate change and creating a more sustainable future.

The Kyoto Protocol

The Kyoto Protocol is an international treaty that was adopted in Japan in 1997 which then came into force in 2005. It extended the 1992 United Nations Framework Convention on Climate Change (UNFCC) which commits industrialized countries to reduce greenhouse gas emissions towards agreed targets. The protocol laid out the path to net-zero by 2050 and set the necessary foundations to reduce emissions by 45 % by 2030 and mitigate climate change at a global scale.

While the Convention asks parties to adopt emission-reducing policies and provide periodic reports, the Kyoto Protocol is based on common but differentiated responsibilities which recognizes that different countries have different capabilities to tackle climate change, and places the obligation on developed countries to reduce current emissions based on the idea that they are responsible for the current emission levels in the atmosphere, and sets binding emissions targets for industrialized nations and economies in transition. The first commitment period ran from 2008-2012 and the Doha Amendment to the Kyoto Protocol extended a second commitment period from 2012-2020.

The Paris Agreement

Negotiations were held at the annual UNFCCC Climate Change Conference in Paris (COP 21) on measures to be taken once the second commitment period of the Kyoto Protocol ended, which led to the 2015 Paris Agreement, an international accord adopted by world leaders from 195 nations to combat climate change, which came into force in 2016.

The goal of the Paris Agreement is to limit global warming to by 2 degrees, or ideally 1.5 degrees Celsius, compared to pre-industrial levels by reducing GHG emissions. It runs on a 5-year cycle of increasingly ambitious climate actions where countries must submit mandatory action plans for each cycle, referred to as nationally determined contributions (NDCs). The Agreement provides an optional opportunity for nations to frame efforts towards the long-term goal by submitting long-term low greenhouse gas emission development strategies (LT-LEDS).

|

The Verra RegistryVerra is a global leader helping tackle the world’s environmental and social challenges by developing and managing standards that help the private sector, countries, and civil society achieve ambitious sustainable development and climate action goals. The standards and programs Verra develops and manages are globally applicable and advance action across a wide range of sectors and activities. Programs undergo extensive stakeholder consultation and expert review, and draw from four key components: standard, independent assessment, accounting methodologies, and registry. |

|

Gold StandardThe Gold Standard (GS) is a voluntary carbon offset program focused on progressing the United Nation’s Sustainable Development Goals and ensuring that project’s benefit their communities. It can be applied to voluntary offset and Clean Development Mechanism (CDM) projects. The GS CDM was launched in 2003 after a two-year consultation with stakeholders, governments, non-governmental organizations, and private sector specialists from over 40 countries. The GS for voluntary offset projects was launched in 2006. The GS project registry – containing all projects implemented through the standard was launched in 2018. |

|

American Carbon Registry (ACR)The American Carbon Registry (ACR), a nonprofit enterprise of Winrock International, was founded in 1996 as the first private voluntary greenhouse gas registry in the world. Winrock operates ACR to create confidence in the environmental and scientific integrity of carbon offsets in order to accelerate transformational emission reduction actions. |

|

Climate Action Reserve (CAR)The Climate Action Reserve (CAR) is an offset registry for global carbon markets. CAR establishes high quality standards for carbon offset projects, oversees independent third-party verification bodies, issues carbon credits generated from such projects and tracks the transaction of credits over time in a transparent, publicly-accessible system. |

|

International Emissions Trading Association (IETA)The International Emissions Trading Association (IETA) is a non-profit association with more than 250 members who are active stakeholders in the international carbon and emissions markets. The organization was created in 1999 to establish a global framework for greenhouse gas emission reductions trading. |

|

The Low Carbon Fuels CoalitionThe Low Carbon Fuels Coalition (LCFC) is a technology neutral trade association dedicated to the support and expansion of market-based low carbon fuel policies. The organization supports market-based low carbon fuel policies that reduce carbon pollution while creating jobs, improving air quality, harnessing waste streams, driving innovation, and stimulating agriculture. |

|

Xpansiv CBLCBL has established the first of its kind Standard Instruments Program (SIP) to build on market infrastructure to accompany and govern the launch of spot contracts for the settlement and physical delivery of environmental commodities across existing registries that can be determined as meeting certain defined, standardized criteria for market quality and performance. |

Related Content

Carbon Offsets

A carbon offset is a transferrable credit certified by governments or certifying bodies to represent an emission reduction of one metric tonne of CO2, or an equivalent amount of other GHGs.

Carbon Markets

Global carbon markets are broken down into two major market types; voluntary carbon markets (also known as VCMs) and compliance carbon markets, which vary by jurisdiction.

Carbon Trading

Carbon Trading is a market-based approach to slowing global warming. Supply and demand set the commodity price on carbon credits, offsets, and renewable energy certificates (RECs).

Environmental Commodities

Learn more about our carbon credit, carbon offset and renewable energy certificate (REC) programs & solutions for compliance and voluntary carbon markets around the world.

Carbon Pricing

A carbon price typically appears as a carbon tax or in emissions trading, with the main policy instrument being an Emissions Trading System (ETS), also known as Cap-and-Trade (CAT) program.